There are certainly many factors in-flux in our world today; inflation rates across the board, rising interest/mortgage rates, volatile stock markets and the war in Ukraine. One would assume that this would dampen the sentiment of Buyers, however the answer is that in some areas it has and in most areas Buyers are still running aggressively in favor of the Seller. We are still seeing half of the offers before the war in Ukraine, anywhere from 5 to 7 offers on our listings. Quality remains strong even though the quantity has been lower. Buyers continue to offer over list price, with non-contingent offers and closing as quickly as their lenders can close.

However, in the last month, we have seen a few odd datapoints of 1 to 2 offers on our listings and some properties that we have offered on. We are not sure if this is a localized phenomenon or a sign of a future market trend. This could be a momentarily blip or a more prolonged leveling. Nationwide some markets have been seeing this cooling as well. The fact of the matter is that inflation is out of control across multiple product sectors and the Federal Reserve plans to be aggressive in getting that under control. This will eventually inevitably slow down the real estate market as well. This level of price appreciation and overbidding was not sustainable and there could be a shift coming in the marketplace.

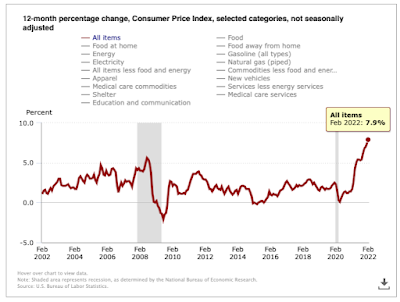

Inflation Rates

Inflation hit another record high in February at 7.9%. The global supply chain issues from COVID are now coupled with further disruptions due to the war in Ukraine. The highest impacted sector is fuel prices due to our boycott of Russian oil and gas further restricting supply.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

Interest Rates

Interest rates have increased from 3.875% to 4% locally for a 30-year fixed jumbo loan. These are still historical lows, but there are mixed reviews on the impact of rising rates. Some Buyers have felt that the increase has priced them out of their target budgets and desired monthly payments. Others are rushing to take advantage of the lower rates before they rise further.

Here are the nationwide 30-year fixed mortgage rates.

30 Year Fixed Mortgage Average Rate

St Louis Federal Reserve

NASDAQ Index

The Technology heavy NASDAQ index fell 9.3% in 2022 since the peak at the beginning of this year, but still up from the lowest point at 20.5% on March 14th, 2022. The NASDAQ is critical as this is the source of down payments for our Silicon Valley home buyers. The volatility of the NASDAQ is likely a concern to home buyers who are not sure how much they can count on this source for their down payments.

Source – Yahoo! Finance

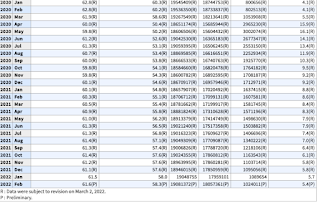

Unemployment Rate

The good news is that the California unemployment rate has come down from the 16% rate back to 5.4%, just a little over 1% of the unemployment rate pre-covid. This means that the workforce is returning to their normal work lives as we all learn to live with COVID. Google mentioned that their workforce would return to the office on a part-time basis in April and Apple has already been back to the office as well. More companies are expected to follow suit.

https://data.bls.gov/pdq/SurveyOutputServlet

Q2 2022 Projections and Beyond

The market will need to be closely monitored. Undoubtedly there is still momentum in most markets in the Bay Area and this Sellers’ market will continue.

However, these macroeconomic factors seem to indicate that there will be a slower market for Sellers in certain locations and for certain product types in the short run. There could be a greater slowdown across the board in the long run. Given the overall low supply and momentum of the market, we are not anticipating overnight changes, but likely a gradual change assuming these economic factors change gradually as well.

As a Buyer, we know it has been a tiring and frustrating journey with the level of multiple offers and levels of price overbids. If you and your family have been in the market for a home, in the short run offers will still be strong, however, opportunities may present themselves in various areas. It might be a good time to come back to the market or continue to put offers in order to get that home for you and your family. Consult our team for a deeper evaluation of your specific target location so that we can better advise you.

A leveling market is the toughest for Sellers. Sellers have had high expectations of multiple offers and extreme overbidding for over the last two years. With the possibility of us coming off peak, rest assured that you have had such a high level of appreciation and you will still have amazing gains. For some you just missed the peak, for others your area may still have momentum. Remember that multiple offers are a great story to tell, but in the end we can only accept one offer. Regardless, we recommend that you strike while the market is still hot. The future no one can predict.

It has certainly been an eventful couple of years in the real estate world. Let us know how we might be of assistance with the real estate needs of you and your family.

3 comments:

Is it on your mind to acquire a home or piece of land? Concerns over the broad choice of loans already on the market are prevalent. If you know precisely what you want and where you want to spend your money, USDA loans can be a perfect alternative for you.

USDA loans

Thanks for sharing Qualitative information properties for rent near me

This is absolutely helpful information. MecKey

Post a Comment