We hope that you and your families had an amazing holiday break and that you had good food and some good rest. We wish you and your families a healthy and prosperous 2022!

2021 Silicon Valley Real Estate Year in Review

2021 was yet another Sellers’ market, in fact the most aggressive that we have seen in over 18 years in the business. The explanation lies at the intersection of housing needs, the influx of wealth and more borrowing power all playing a critical role.

The first pillar of the Maslow Hierarchy of Needs identifies shelter as a basic human need. With COVID variants mutating with no end in sight, the local workforce will continue to work from home for the foreseeable future. With these circumstances, a home office is a key requirement creating the need to upsize to a home with more bedrooms and more space overall. Outdoor space remains critical, as it is still safer to congregate outdoors rather than in tight indoor spaces. The second factor attributing to this aggressive buyer pool is that Buyers have increasing wealth from their company stock options. The NASDAQ index increased by 23% in 2021, putting wealth in the pockets of our local technology workers. Homeowners that were looking to upsize, also had equity in their previous primary homes as well. Lastly, interest rates though up slightly, remained at historical lows in 2021, thereby increasing Buyers purchasing power on homes.

NASDAQ Index

Interest Rates

Interest rates have stayed low in the 2.5% to 3.5% range. These are still historical lows, undoubtedly a key contributor to increasing home prices due to higher buying power for buyers.

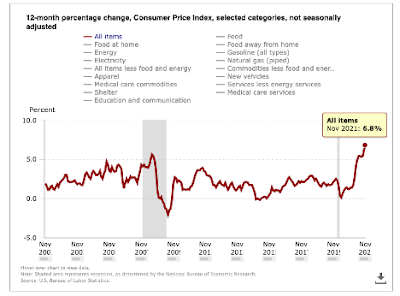

Inflation Rates

Inflation hit a record high in November at 6.8%. Over the past 20 years, inflation has hovered generally around 2%. Like many businesses, when COVID hit, businesses lowered demand expectations and their workforces were forced to work from home. The lockdown pandemic created a high rate of consumer savings and when we emerged from the worst of the pandemic, the demand for food, goods, services, vehicles, etc all skyrocketed. This demand shocked the already disrupted supply chain, with labor shortages and created a shortage of products. Heavy demand and low supply equated to increased prices and subsequently inflation. When it comes to manufacturing and supply chain processes in a global economy, it is difficult to simply jumpstart that engine within an ongoing pandemic.

https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

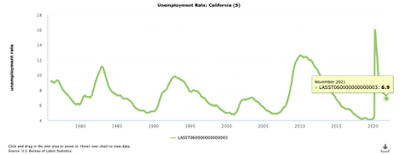

Unemployment Rate

California unemployment has dropped from the early pandemic high of 16% in April of 2020 to 6.9%. This is a good trend for the job market overall.

https://data.bls.gov/pdq/SurveyOutputServlet

2022 Real Estate Outlook

In the short run, low inventory and high demand will likely keep real estate prices high and competition fierce. The biggest concern is the inflation rate and will that stabilize over time? Will our supply chain ramp up to meet demand thereby lower prices naturally, or will this continue to be an issue. The Federal Reserve does not appear to be interested in taking the wait and see approach. They plan to raise interest rates three times in 2022. The impact is yet to be determined based on how aggressively the rates are increased. Regardless, rate hikes will eventually affect the interest rates on mortgages and if done aggressively could lower home buying power and slow down the rate of price increases. If this also dampens the mood of the stock markets, we could have 2 key pillars of home buyer aggression neutralized. This could create a more balanced market overall. My projection would be that in the short run little will change and perhaps the latter half of 2022 we may see some possible leveling in the market, but will it be enough to overcome Buyers’ housing needs? That is yet to be seen.

Schedule Your Custom Real Estate Strategy Consultation Meeting

Everyone family has a unique real estate scenario specific to their needs and circumstances. We are always available to have a strategic consultation meeting with you to address your needs and come up with an execution plan. Book your consultation with us today at homes@alanwangrealty.com or call and text us at (408)313-4352.

Again stay safe and have an amazing 2022!